What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict credit worthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and you do manage to get approved for credit then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can save many thousands of dollars over the life of your mortgage, auto loan, or credit card.

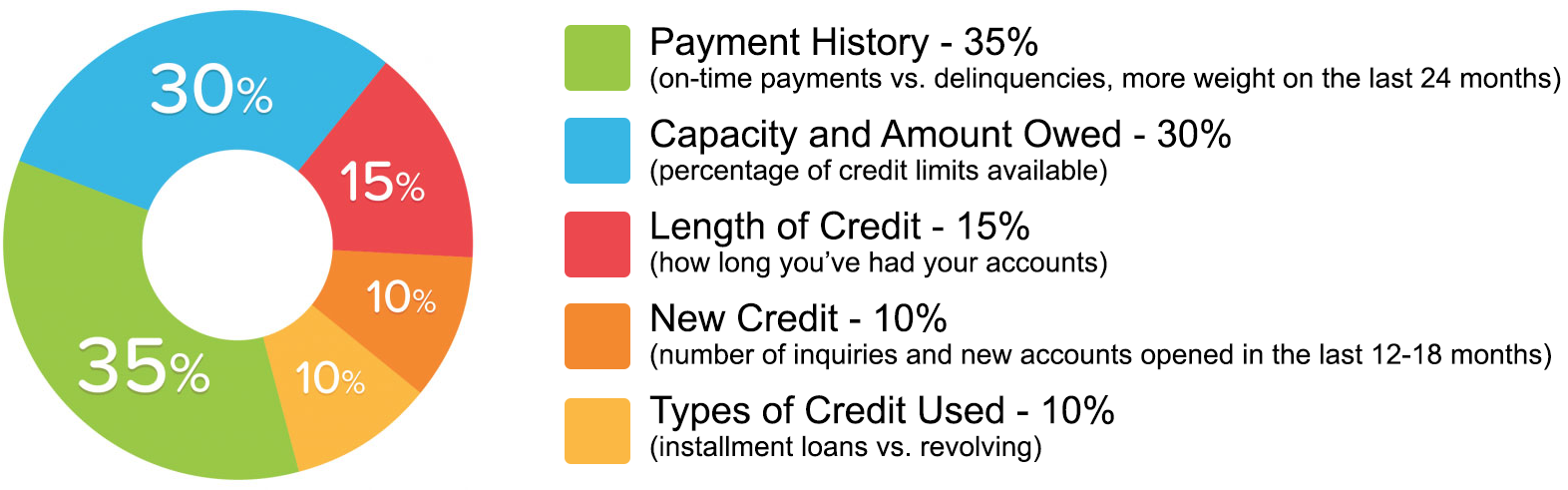

What affects your Credit Score?

We will help you to dispute negative items in your payment history.

- We will show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

- We can also help you to removing credit inquiries from your credit report. Most people are aware of the three credit reporting bureaus, Equifax, Experian and TransUnion. The average difference in scores between the highest and lowest of your credit scores, from the three bureaus, is 60 points. This is the result of the credit bureaus having different items on their report, which may be correct, incorrect or are not reported in full compliance with credit law. According to a recent study, nearly 80% of all credit reports have serious errors on them and this does not even include the even smaller errors for which we look.

Information that cannot be in a credit report:

- Medical information (unless you provide consent)

- Notice of bankruptcy (Chapter 11) more than ten years old

- Debts (including delinquent child support payments) more than seven years old

- Age, marital status, or race (if requested from a current or prospective employer)